Today’s Gold Price in Pakistan – Updated 15 July 2025. Check latest gold and silver rates per tola and gram, based on international market trends and updates.

As someone who’s long been a quiet investor in both gold and silver, I’ve learned the importance of keeping an eye on fluctuations in prices—especially those tied to international market changes. On Tuesday, July 15th, 2025, the latest updated rates in Pakistan clearly show some notable shifts that every buyer, whether for personal use or long-term interest, should be informed about. Having tracked these trends across different seasons, I can say that knowing how to react to such changes truly helps in making smarter decisions. Whether you’re buying gold for jewelry, investment or even gifts, it’s vital to continue following the track of daily rates to stay ahead. The current market activity doesn’t just reflect numbers—it tells a story of demand, economic confidence, and geopolitical undercurrents, all converging into today’s updated snapshot.

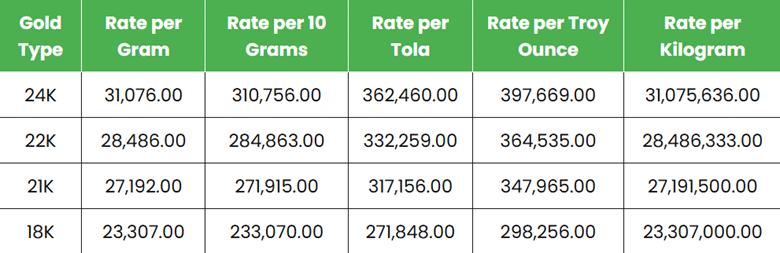

Gold Rate Today (July 21, 2025)

Why Do Gold Prices Keep Changing in Pakistan?

Having spent years navigating the local Sarafa markets from Karachi to Lahore and Islamabad, I’ve seen firsthand how closely tied gold prices in Pakistan are to international market shifts. These fluctuate not randomly, but due to multiple factors like global demand and supply, economic and geopolitical events, and the exchange rate between USD and PKR. The slightest change in interest rates, inflation trends, or political uncertainty can trigger visible changes in rates, all of which are reflected daily by local dealers. Because the markets are operating in several key cities, the variation is often based on regional demand. In my experience, the best way to keep up is to monitor not only the Pakistan markets, but also what’s happening globally, as even a rumor abroad can ripple into sudden price jumps here.

Should You Buy Gold Today?

From my own experience watching the daily fluctuations in gold over the years, the current rate of Rs. 359,710 per tola for 24 Karat gold stands out as a key consideration for both seasoned investors and casual buyers alike. If you’re thinking about investing in gold, today’s price offers a good insight into the prevailing trend, and it might be wise to act before potential spikes occur. Whether your purpose is long-term investment, hedging against inflation with an inflation-resistant asset, or simply acquiring jewelry, it’s important to follow the momentum and make an informed choice. Personally, I’ve found that investment in gold is never just about the metal itself—it’s about timing, watching the trend, and evaluating if the rate you see today truly aligns with your financial strategy.

Final Word – Today’s Gold Price in Pakistan – Updated 15 July

In my years of observing gold and silver prices in Pakistan, one thing remains constant: the ongoing volatility of the international market continues to reflect heavily on local rates. Whether you’re buying for investment, gifts, or wedding preparations, it’s crucial to check the updated prices before making any purchase. Personally, I never proceed without visiting multiple reliable sources to get the most current information—a habit that’s saved me from poor timing more than once. Today’s shifts in the market may seem minor, but they can significantly influence your financial outcomes, especially when dealing with precious metals.

Calculate Gold Rates in Gram

If you’re like me and prefer precision when it comes to gold prices, then using a proper calculator tool is a game-changer. Simply type the desired gramage in the text box to calculate the rate for 24K gold—this method has helped me get a clear snapshot of both current and historical rates. With our enhanced conversion system, you can easily run detailed calculations using our digital tools without any confusion. Whether you’re making a purchase or just analyzing market movement, having access to a reliable gold rate conversion tool makes all the difference.

What Causes Price Fluctuations in Gold Prices?

In all my years studying gold as both a piece of jewelry and a serious investment, I’ve learned that its value is never static—it’s constantly being affected by a mix of global market factors. The prices you see daily are shaped by potential drivers like interest rates, monetary policy, geopolitics, and overall risk appetite or aversion in currency and equity markets. When the U.S. Dollar strengthens, it often makes gold more expensive for foreign investors, while a weaker dollar can make it more attractive, creating a positive pull on demand. In countries like India, which is home to a strong tradition of gold buying, seasonal demand can push prices rising or falling, depending on whether demand is soft or robust. Every daily movement is a reflection of something deeper—be it inflation, deflation, or even dividends foregone in favor of holding a major, stable asset. What’s most interesting is how even the opportunity cost can become a primary catalyst, making gold feel like a safe harbor when uncertainty strikes, and that dynamic is always reflected in the live index.

Gold Prices for Different Purities

As someone who regularly tracks gold trends in Pakistan, I’ve learned that prices can significantly vary depending on the purity level, and knowing the difference is essential for smart buying. The most sought-after is 24K pure gold, often the expensive choice, but for those seeking value, 22K, 21K, and 18K options are also common. Based on today’s market, the respective rates stand at approximately PKR 215,000 per 10 grams for 22K, around 205,000 for 21K, and estimated at 175,000 for 18K. These figures may fluctuate, so I always make it a point to check with local dealers for the most accurate pricing before making any decisions.

Gold Measurement Conversions

From my experience in purchasing and selling gold, getting a solid understanding of measurement units is absolutely crucial—especially in markets like Pakistan where gold is typically sold by weight. The most common units are grams and tolas, and being able to convert between them quickly makes a big difference when calculating the price. For reference, 1 Tola equals 11.663 grams, and 1 Gram is about 0.0857 Tola, so keeping these conversions in mind can save you both time and costly mistakes in real-world buying scenarios.

Today’s Gold Price in Pakistan – Updated 15 July: Conclusion

Understanding the dynamics behind gold price movements isn’t just for analysts or seasoned investors—it’s essential for anyone considering investment, jewelry purchases, or even tracking economic trends. From global market shifts and monetary policy changes to local demand in places like India, every factor—be it inflation, interest rates, or currency fluctuations—plays a role in shaping daily prices. As the U.S. Dollar strengthens or weakens, and as investor appetite adjusts in response to geopolitics or economic signals, gold remains a timeless asset that continues to reflect both stability and opportunity. By staying informed and using the right tools, you can navigate these fluctuations with confidence—whether you’re making your first purchase or refining a long-term investment strategy.