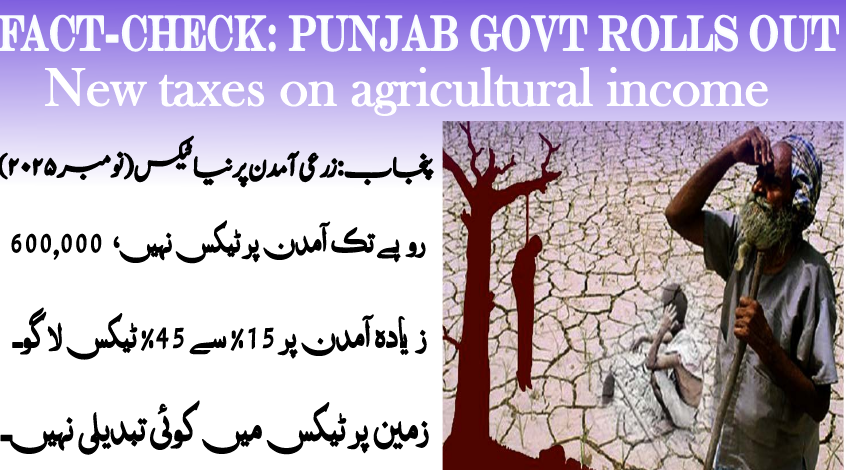

Punjab Govt Imposes New Agricultural Income Tax from 15% to 45% on earnings above Rs. 600,000. Small farmers remain exempt under 2024 amendments.

A widely circulated claim on WhatsApp and Facebook asserts that the Punjab government has introduced new taxes on agricultural income, ranging from 15% to 45%. These claims have caused confusion among the farming community, prompting concerns about their authenticity. A thorough fact-check confirms that the Punjab government has indeed implemented updated tax slabs through an amendment to the Punjab Agricultural Income Tax Act, 1997 in November 2024. However, the changes are targeted, tiered, and contain exemptions for low-income farmers. This article outlines the verified details, legal basis, updated tax structure, and implications for farmers across the province.

What Social Media Claims About Agricultural Income Tax

One of the viral messages reads: “As per new amendments to the law, a 15% tax will be imposed on the annual agricultural income of Rs. 12 lacs in Punjab.” Another post claims, “In Punjab, a tax of up to 45% has been imposed on farmers.” The messages further allege that farmers earning up to Rs. 600,000 annually will be exempt, while those earning Rs. 1.2 million or more will face a 15% tax rate.

These claims are not fabricated but lack context. They omit the details of the progressive tax structure, income thresholds, and the continued exemptions for small landholders and low-income cultivators.

Verified by Punjab Board of Revenue and Geo Fact Check

Geo Fact Check confirmed the claims through official documents from the Punjab Board of Revenue. According to the Board’s Public Relations Officer Mazhar Hussain, the government has implemented a new tax structure based on agricultural income and land size. These changes came into effect following amendments made in November 2024.

The update replaces older flat-rate structures with a progressive slab system, ensuring that only higher-income farmers bear a substantial tax burden.

Revised Agricultural Income Tax Slabs/Punjab Govt Imposes New Agricultural Income Tax

The revised tax structure categorizes agricultural income into slabs, much like conventional income tax on salaried individuals. This ensures equity and protects subsistence-level farmers from taxation.

| Annual Agricultural Income (PKR) | Tax Rate | Tax Payable |

|---|---|---|

| Up to Rs. 600,000 | 0% | Fully exempt |

| Rs. 600,001 – Rs. 1,200,000 | 15% | 15% of income exceeding Rs. 600,000 |

| Rs. 1,200,001 – Rs. 1,800,000 | 20% | Rs. 90,000 + 20% on amount over Rs. 1.2M |

| Rs. 1,800,001 – Rs. 2,500,000 | 25% | Rs. 210,000 + 25% on amount over Rs. 1.8M |

| Rs. 2,500,001 – Rs. 3,500,000 | 30% | Rs. 385,000 + 30% on amount over Rs. 2.5M |

| Rs. 3,500,001 – Rs. 5,600,000 | 35% | Rs. 685,000 + 35% on amount over Rs. 3.5M |

| Above Rs. 5,600,000 | 45% | Rs. 1,610,000 + 45% on amount over Rs. 5.6M |

This model ensures fair taxation: higher earners pay proportionally more, while those with limited agricultural income remain exempt.

Land Tax Details Under the Punjab Agricultural Income Tax Act, 1997 (2024 Update)

In addition to income-based taxation, the Punjab government continues to levy land-based agricultural taxes. These are calculated based on the type and area of cultivated land and are charged annually. As per the November 2024 update, no changes have been made to land tax rates, maintaining stability for small farmers.

| Type of Agricultural Land | Classification | Annual Tax Rate (Per Acre) | Applicability |

|---|---|---|---|

| Irrigated Land | Canal/tube well-fed lands | Rs. 150 | Applies to high-yield farming lands |

| Unirrigated Land (Barani) | Rain-fed lands | Rs. 100 | Common in arid zones |

| Orchards | Fruit-bearing tree farms | Rs. 200 | Higher due to commercial value of crops |

| Barren/Waste Land | Unusable lands | Rs. 0 | Exempt from taxation |

| Tenant-Occupied Land | Leased to farmers | Varies | Owner remains responsible unless otherwise agreed |

Key Notes on Land Tax:

- Tax is assessed by acreage and type of cultivation, not income.

- Farmers owning less than 6.25 acres (irrigated) or 12.5 acres (unirrigated) may be exempt under provincial support policies.

- Landowners are liable for tax even if land is cultivated by tenants.

- Non-payment can result in revenue recovery, land record blocking, or financial penalties.

Legal Background and Policy Objectives

The Punjab Agricultural Income Tax Act, 1997 is the governing law for both income-based and land-based taxes. The November 2024 amendment was passed by the Punjab Assembly and brought into effect for Fiscal Year 2024–25.

According to officials at the Punjab Finance Department, the tax reform has three main goals:

- Increase provincial revenue for rural infrastructure and development.

- Ensure equitable taxation between agriculture and non-agricultural sectors.

- Formalize high-income agricultural enterprises and bring them into the tax net.

Implementation and Compliance Requirements

Farmers must now declare their agricultural income annually by submitting Form AI-1 to the Punjab Board of Revenue. The deadline for filing is June 30 of each fiscal year. Those failing to comply may face:

- Penalties and fines

- Land record blocks

- Possible legal action for tax evasion

To support compliance, the government has launched:

- A digital tax calculator on the Punjab Revenue portal

- Farmer guidance hotlines

- District-level awareness workshops

Stakeholder Reactions to Agricultural Income Tax Reform

Farmer Unions

Groups like the Punjab Farmers Association have expressed concerns over the impact on medium-scale landowners. However, they acknowledged that the exemption threshold of Rs. 600,000 protects most smallholders.

Agricultural Economists

Experts from Lahore School of Economics and Punjab University endorsed the reform, noting it helps reduce fiscal inequality. According to economist Dr. Farooq Hassan, “Only farmers with significant profits will pay substantial tax. This is a responsible step toward sustainable revenue collection.”

Clarification on Social Media Misunderstanding

While the core of the WhatsApp and Facebook messages was accurate, they omitted crucial details:

- Progressive slabs, not flat tax

- Exemption limits

- Unchanged land tax

- Legal context

This led to public confusion, especially among low-income farmers who feared immediate and unaffordable taxes. In response, the Punjab Board of Revenue issued clarifications through press releases and public notices.

Tools for Farmers and Taxpayers

To simplify compliance, the Punjab government is offering:

- Online calculator tools for estimating liability

- AI-powered mobile apps for return filing

- Help centers at tehsil offices

- WhatsApp helplines for rural areas

These initiatives aim to make tax compliance accessible and reduce dependence on tax consultants.

Final Word: Punjab Govt Imposes New Agricultural Income Tax

Yes, the Punjab government has rolled out new taxes on agricultural income following the 2024 amendment. The claim circulating online is true, but must be understood within context. Taxes now follow a progressive model, exempting farmers earning below Rs. 600,000 annually, while targeting high-earning landholders. Land tax rates remain unchanged, ensuring small farmers are protected.

Farmers are advised to consult official sources like the Punjab Board of Revenue for accurate details and to meet their tax obligations responsibly. This reform marks a significant move toward modernizing agricultural taxation while ensuring fairness and sustainability.

Уникальные букеты ко дню рождения для девушек с доставкой по Москве — это отличный способ порадовать любимую в её особенный день. Любой букет цветов может быть настоящим произведением искусства. Мы предлагаем широкий выбор оригинальных букетов.

Оригинальные букеты на день рождения девушке с доставкой в Москве.

Флористы не просто составляют букеты, они занимаются настоящим искусством. Цветы могут передавать глубокие эмоции и чувства. Подбирайте букеты, которые отражают характер вашей девушки, и мы поможем осуществить ваш выбор.

Доставка букета в Москве — удобная услуга, которую предлагают многие сервисы. Есть возможность заказать доставку на любой удобный для вас момент, и ваш подарок прибудет вовремя. Не забывайте учитывать предпочтения вашей девушки в выборе цветов, чтобы сделать её день особенным.

Не бойтесь экспериментировать и заказывать букеты с необычными цветами. Это может добавить индивидуальности и уникальности вашему подарку. Профессиональные флористы помогут вам подобрать идеальный вариант для вашей любимой.