Apply for the Asaan Karobar Card Apply online and get up to PKR 1 million interest-free loan. Check eligibility, benefits & register now at akc.punjab.gov.pk.

As someone running a small business in Punjab, the launch of the CM Punjab Asaan Karobar Card felt like a breakthrough. This program by the Punjab government offers interest-free loans up to PKR 1 million, aimed at helping SMEs and entrepreneurs grow, thrive, and sustain operations. What impressed me was the use of digital tools like POS systems and mobile apps that ensure transparency and convenience. I was able to register and apply online through akc.punjab.gov.pk in just minutes. This card isn’t just a loan—it’s a path to economic growth, designed to empower small business owners and drive change across Punjab. The step-by-step guide made it easier than ever to complete the registration and access key services.

Interest-Free Loan Scheme (Asaan Karobar Card Apply Online)

After applying for the Interest-Free Rs. 1 Million Loan Scheme, I made sure to keep my phone on and checked every message, knowing the confirmation would come via SMS or phone call. Soon enough, I received the update and was guided to collect my Business Card/ATM from either the Bank of Punjab or through TCS delivery. Holding the card that reflected the approved loan amount felt like a big step forward. Many applicants have already started receiving their cards, each initially loaded with Rs. 500,000, which marks the beginning of financial support that’s both practical and timely for small business owners like myself.

The second card will be issued after some time.

جن لوگوں نے بلاسود 10 لاکھ قرضہ سکیم میں اپلائی کیا ہے، ان سے گزارش ہے کہ وہ اپنے فون آن رکھیں اور باقاعدگی سے میسجز چیک کرتے رہیں، کیونکہ سب سے پہلے اطلاع SMS یا کال کے ذریعے دی جاتی ہے۔ اطلاع ملنے کے بعد آپ اپنا کاروبار کارڈ/ATM پنجاب بینک یا TCS کے ذریعے حاصل کر سکتے ہیں۔ مجھے خود ایک کال موصول ہوئی جس میں بتایا گیا کہ کارڈ بینک پہنچ چکا ہے، اور جلد ہی مجھے پہلا کارڈ ملا جس میں پانچ لاکھ روپے موجود تھے۔ اب مزید درخواست گزاروں کو میسجز موصول ہو رہے ہیں اور وہ اپنے کارڈز حاصل کر رہے ہیں۔ دوسرا کارڈ کچھ وقت بعد جاری کیا جائے گا، جس میں باقی رقم شامل ہو گی اور یوں اس فائدہ مند سکیم کے تحت مکمل رقم فراہم کی جائے گی۔

84 Billion Rupees Allocated for Aasaan Karobaar Scheme

Under the vision of Maryam Nawaz Sharif and the leadership of the Punjab Chief Minister, the province has launched its most ambitious business finance program yet — the Aasaan Karobaar Finance Scheme alongside the Aasaan Karobaar Card Scheme. With a staggering 84 billion rupees earmarked, including 48 billion rupees specifically allocated for the Card, this initiative aims to uplift young entrepreneurs, startups, and small business owners through interest-free loans. As someone working on a new venture, I see this as more than just funding — it’s a bold step toward economic growth, financial inclusion, and sustainable job opportunities across Punjab. These schemes don’t just provide money; they enable people to become real contributors to the region’s economic development.

| Key Features | Details |

| Maximum Loan Limit | PKR 1 million |

| Interest Rate | 0% |

| Loan Tenure | 3 years |

| Grace Period | 3 months |

| Loan Type | Revolving credit facility |

| Application Process | Online via akc.punjab.gov.pk |

How to Apply for the Asaan Karobar Card

Follow these simple steps to apply for the Asaan Karobar Card:

- Visit the official website: https://akc.punjab.gov.pk

- Fill out the online application form with accurate personal and business details

- Pay the non-refundable processing fee of PKR 500

- Upload required documents: your CNIC and proof of residence

- Wait for digital verification of your CNIC, business premises, and creditworthiness by authorized agencies

- Upon approval, your Asaan Karobar Card will be issued for business-related transactions

- For queries or assistance, contact the helpline at 1786

These steps make the entire registration process fast, convenient, and transparent.

Step 1: Access the Official Portal

Open your web browser and navigate to akc.punjab.gov.pk. Once on the homepage, click the “Register Now” option.

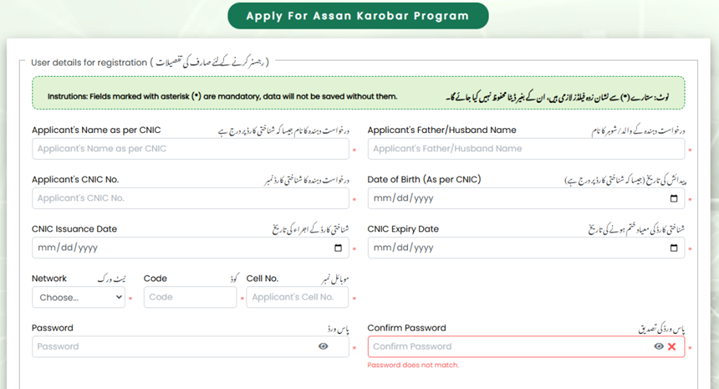

Step 2: Complete the Registration Form

- Provide Personal Details

- Enter your full name exactly as per your CNIC

- Input your CNIC number

- Specify your date of birth (as mentioned on your CNIC)

- Enter your father’s or husband’s name

- Fill in the CNIC issuance and expiry dates

- Add Contact Information

- Provide a valid mobile number and select your mobile network

- Ensure the mobile number is active to receive confirmation and updates

- Set Up a Password

- Create a strong password for your account

- Re-enter the password to confirm, making sure both entries match

Accurately filling out these details will help ensure a smooth and successful registration for your Asaan Karobar Card.

Step 3: Review and Submit

Carefully review all the information you’ve entered in the registration form to ensure everything is accurate and matches your official documents. Once you’ve double-checked the details, click the “Register” button to proceed. If your registration is successful, a confirmation message will be sent to your mobile phone to notify you.

How to Log In to Your Asaan Karobar Card Account

Once you’ve completed your registration, logging into your Asaan Karobar Card account is simple. Just follow these steps:

Step 1: Visit the Login Page

- Go to the official website: https://akc.punjab.gov.pk

- Click on the “Login” option

Step 2: Provide Your Credentials

- Enter your CNIC number

- Input the password you created during registration

Step 3: Access Your Dashboard

- Click the “Login” button

- You will be redirected to your dashboard, where you can explore all the available services under the Asaan Karobar Card program

Tips for a Smooth Login Experience

- Ensure the information you enter exactly matches your registered details

- Use a stable internet connection to prevent any interruptions during the login process

- Keep your password secure and never share it with anyone to protect your account

About the Asaan Karobar Card Program

The CM Punjab Asaan Karobar Card is a groundbreaking program tailored to empower small businesses across Punjab by offering interest-free loans of up to PKR 1 million. This initiative enables entrepreneurs to tackle financial hurdles and concentrate on business growth without the burden of markup. With a revolving credit facility and flexible repayment options, it provides a sustainable financial path for SMEs to expand or stabilize their ventures. More than just a loan scheme, it reflects the Punjab government’s strong commitment to strengthening entrepreneurship and driving the provincial economy forward.

Eligibility Criteria

To qualify for the Asaan Karobar Card, applicants must meet the following requirements:

- Must be a Pakistani national and a resident of Punjab

- Be aged between 21 and 57 years

- Possess a valid CNIC and a registered mobile number

- Own or plan a business located in Punjab

- Have a clean credit history with no overdue loans

- Pass psychometric and credit assessments conducted by authorized agencies

- Register the business with PRA/FBR within six months of receiving the card

- Only one application is allowed per individual or business

These criteria ensure the scheme remains focused on supporting genuine small business owners in need of financial assistance.

Loan Usage and Repayment Details

The Asaan Karobar Card offers flexibility in loan usage and repayment

- Initial 50% Disbursement: Borrowers can access half of the approved loan amount during the first six months after loan approval.

- Grace Window: A three-month period is granted before the borrower begins repayment.

- Monthly Repayments: Installments start with a minimum of 5% of the remaining loan balance paid monthly.

- Remaining 50% Release: The second half of the loan becomes available after the timely and proper use of the first portion.

- EMI Structure: After one year, the remaining amount is paid in equal monthly installments over the next 24 months.

Funds are strictly for business purposes like paying vendors, utility bills, and official government fees. Use for personal or unrelated transactions is not permitted.

Charges and Fees

To keep the program affordable yet sustainable, minimal charges apply:

- Annual Maintenance Fee: PKR 25,000 plus FED, which is deducted directly from the approved loan limit.

- Additional Costs: Include life insurance, card creation, and delivery charges.

- Late Installment Fee: Penalties are applied in accordance with the bank’s policy on overdue payments.

These costs are kept modest to offer maximum advantage to entrepreneurs while maintaining the financial health of the scheme.

How to Check Your Asaan Karobar Loan Application Status

Applicants can easily monitor their loan request through various platforms. Whether you’re within Pakistan or abroad, the tracking system ensures transparency and accessibility. Simply visit the official portal and log in using your registered credentials to view your current status—either “Approved” or “Under Review.”

Ways to Track Your Asaan Karobar Application

- Through the Online Portal: Log into your profile to receive real-time updates. If additional documents are required, you can upload them under the “Uploads” section.

- Via SMS: Text “STATUS [Application ID]” to 8300 to instantly receive your loan update.

- By Phone: Call the toll-free helpline at 051-9053333 (domestic) or +92-51-9053333 (international) for status inquiries and assistance.

- In Person: Visit any nearby NBP branch with your CNIC to inquire about your loan progress.

What to Do If Your Application is Delayed

If your application remains pending or displays incorrect status:

- Cross-check your status using at least two different methods.

- Re-upload any missing documents in the “Uploads” section of the portal.

- Ensure all personal information matches NADRA records exactly.

- Contact customer service with your reference number to resolve the issue promptly.

Staying on top of your status ensures a smoother experience and prevents unnecessary delays in loan disbursement.

Key Features of the Asaan Karobar Card

- Zero Interest Financing: Borrow up to PKR 1 million with no markup involved.

- Digital Payments: Make business-related payments like bills and fees via mobile apps and POS systems.

- Cash Availability: Withdraw up to 25% of your loan for flexible business needs.

- Repayment Grace Period: Enjoy three months before your first payment is due.

- Revolving Loan Option: Reuse available funds during the initial year, followed by structured repayment over two years.

Benefits of the Asaan Karobar Card

This program delivers powerful advantages to entrepreneurs and small-scale businesses:

- Access to Capital: Offers funding to help businesses grow and operate smoothly.

- Clear Transactions: Ensures transparent use of funds through digital monitoring tools.

- Growth-Oriented: Supports expansion and daily business operations.

- Broad Coverage: Targets diverse small businesses across Punjab.

- Simple Process: Fully digital and easy to navigate, from application to approval.

Helpline for Asaan Karobar Card

Need help? Reach out to the official support team:

- Phone Support: Call 1786 for any inquiries or technical assistance.

- Service Scope: Get help with signing up, checking eligibility, or completing the application.

- Timings: Helpline operates during standard working hours.

- Official Portal: For full details, visit akc.punjab.gov.pk.

FAQs

How to apply for the Asaan Karobar Card Apply online?

To apply for the Asaan Karobar Card online, visit the official portal at https://akc.punjab.gov.pk. Complete the registration form with accurate personal and business details, upload your documents, pay the PKR 500 processing fee, and submit your application digitally.

What is the Asaan Karobar Card and who can apply for it?

The Asaan Karobar Card Apply Online scheme is an interest-free loan program initiated by the Government of Punjab to financially support young entrepreneurs, small business owners, and startups. Individuals residing in Punjab with a valid CNIC and a business idea or existing setup are eligible to benefit from this initiative.

What documents are required for Asaan Karobar Card Apply Online?

While applying under the Asaan Karobar Card Apply Online process, you must provide a valid CNIC, proof of residence, active mobile number, and accurate business-related information. These documents are digitally verified before approval.

How much loan is provided and how is it repaid?

Under the Asaan Karobar Card Apply Online scheme, you can get an interest-free loan of up to PKR 1 million, disbursed in two phases. The repayment begins after a 3-month grace period, starting with 5% monthly payments, followed by EMIs over 24 months.

How to check status of Asaan Karobar Card application?

After completing your Asaan Karobar Card Apply Online process, you can track your loan status through the official website, via SMS to 8300, or by calling the helpline 051-9053333. You can also visit your nearest NBP branch with your CNIC for a manual status check.